Understanding Correspondent Hotel Lenders: A Comprehensive Guide to Securing the Right Loan for Your Hotel

If you’re considering financing for a hotel project—whether it’s construction, acquisition, or renovation—choosing the right lender is one of the most critical decisions you’ll make. Among the various financing options available, working with a correspondent hotel lender offers unique benefits, including access to multiple loan programs, in-house underwriting, and specialized knowledge of the hotel industry. In this blog, we’ll dive deep into what correspondent hotel lenders are, how they work, and how they can help you secure the best loan for your hotel business.

What is a Correspondent Hotel Lender?

Correspondent hotel lenders serve as intermediaries between you, the borrower, and a network of financial institutions, including banks and investors. They have the flexibility to offer multiple loan products and act as a direct point of contact, simplifying the entire loan process. Instead of approaching multiple banks yourself, correspondent lenders work on your behalf to find the best loan product tailored to your specific needs.

While correspondent lenders do not directly fund loans from their own balance sheets, they perform key functions like underwriting, servicing loans, and maintaining relationships with larger financial institutions that provide the actual funds. This allows them to offer a wide variety of loan products that cater to different hotel projects.

Key differences between correspondent and direct lenders:

Correspondent lenders serve as intermediaries, providing access to several loan options from different financial sources.

Direct lenders fund loans themselves and may offer limited flexibility in loan products.

Benefits of Working with Correspondent Hotel Lenders

Access to Multiple Loan Programs

One of the most significant advantages of working with a correspondent hotel lender is their access to a wide range of loan programs. Instead of limiting you to the products offered by a single institution, they can connect you with lenders offering SBA loans, bridge loans, permanent financing, and more.

In-House Underwriting for Faster Approvals

Because correspondent lenders manage the underwriting process in-house, they have more control over the timeline and can offer faster loan approvals compared to traditional lenders. The underwriting process is crucial in assessing the risk and determining the terms of your loan, and having it done in-house makes the process smoother.

Specialized Knowledge in Hotel Lending

Hotel projects are unique and come with specific financial challenges, such as seasonal revenue fluctuations, high operating costs, and significant upfront capital requirements. Correspondent hotel lenders often have specialized knowledge and experience in the hospitality sector, allowing them to structure loans that meet the unique needs of hotel operators.

Personalized Loan Structuring

Hotel projects vary widely in scope and scale—from boutique hotel renovations to large-scale new construction. Correspondent hotel lenders can work with you to customize a loan that fits your specific project, whether it’s a short-term bridge loan or a long-term fixed-rate loan.

Types of Loans Offered by Correspondent Hotel Lenders

Correspondent hotel lenders offer a variety of loan types to meet the needs of hotel owners and developers. Some of the most common loan options include:

SBA Loans for Hotels

SBA 504 Loan: This is a government-backed loan program designed for purchasing large fixed assets like real estate and equipment. It’s ideal for hotel acquisition or construction because of its low-interest rates and long repayment terms.

SBA 7(a) Loan: Another government-backed loan option, the SBA 7(a) loan, offers flexibility for hotel owners looking to refinance existing debt, purchase a hotel, or fund renovations.

Bridge Loans

Bridge loans are short-term financing solutions used to “bridge the gap” between the current financing needs and long-term funding. These are ideal for hotel projects undergoing renovation or in transition, allowing hotel owners to meet immediate capital needs.

Conventional Loans for Hotel Financing

Conventional loans offered by correspondent lenders are non-government-backed loans that can be used for a wide variety of hotel projects. These loans often come with competitive rates and terms, and they can be customized to fit the needs of hotel developers.

Hotel Construction Loans

For new hotel developments, construction loans provide the necessary capital to cover building costs. Correspondent hotel lenders can help structure these loans based on project timelines and expected completion dates.

How Correspondent Lenders Navigate Hotel Market Trends

Correspondent hotel lenders keep a close eye on market trends and economic indicators that can impact hotel financing. Their ability to assess risk based on real-time data is crucial for approving loans.

Market and Economic Impact on Hotel Loans

The hospitality industry is highly sensitive to market fluctuations and economic conditions. For example, during times of economic downturn, hotel occupancy rates may decrease, affecting profitability. Correspondent lenders have the experience to factor in these variables and structure loans accordingly to mitigate risks.

Assessing Hotel Performance Metrics

Before approving a loan, correspondent lenders often look at key performance metrics, such as occupancy rates, average daily rate (ADR). These metrics help lenders determine the financial health of the hotel and its ability to repay the loan.

How to Choose the Right Correspondent Hotel Lender

Selecting the right correspondent lender for your hotel project is critical to its success. The following advice will help you make the best decision:

Consider Experience and Reputation

A lender’s experience in the hotel industry is a significant factor. You want to work with a correspondent lender who understands the specific challenges of hotel financing.

Evaluate Loan Product Variety

Ensure that the lender offers a wide range of loan options tailored to different aspects of hotel financing. This could include SBA loans, bridge loans, and permanent financing options.

Ask the Right Questions

Before committing to a correspondent lender, ask the following questions:

How many hotel loans have you financed in the past?

What types of loan products do you offer for hotel financing?

How quickly can you close a hotel loan?

The Future of Hotel Financing with Correspondent Lenders

The landscape of hotel financing is evolving, with new trends emerging that can affect how loans are structured and approved. Here’s a look at some trends shaping the future:

Green Financing Initiatives

As sustainability becomes a focal point for many hotel developers, correspondent lenders are increasingly offering green financing options. These loans support environmentally-friendly hotel projects, from energy-efficient buildings to sustainable operational practices.

Technological Advancements in Loan Processing

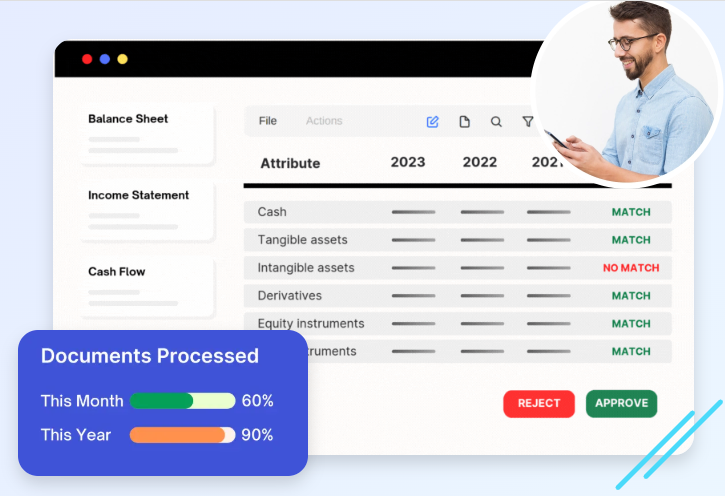

Technology is revolutionizing the loan approval process. Digital underwriting tools, AI-driven risk assessments, and faster communication channels between lenders and borrowers are speeding up loan approvals.

Case Studies: Success Stories with Correspondent Hotel Lenders

Case Study 1: Boutique Hotel Renovation in Miami A boutique hotel in Miami needed $3 million to undergo extensive renovations. The hotel owner worked with a correspondent lender who secured a short-term bridge loan to cover the renovation costs. Thanks to the lender’s in-house underwriting and expertise in hotel financing, the loan was approved within 30 days, allowing the owner to complete the renovations on time.

Case Study 2: New Hotel Construction in Denver A hotel developer in Denver sought financing for a $20 million new construction project. The correspondent lender helped structure a construction loan, followed by permanent financing once the project was complete. The lender’s access to multiple loan programs and thorough understanding of the hospitality market helped the developer secure the best possible terms.

Frequently Asked Questions (FAQs)

Q: What is the main advantage of working with a correspondent hotel lender?

A: Correspondent hotel lenders offer access to multiple loan products from various financial institutions, providing flexibility and tailored solutions for your hotel project.

Q: How fast can I get a loan approval from a correspondent hotel lender?

A: With in-house underwriting, correspondent lenders often expedite the approval process, with some loans being approved in as little as 30-45 days.

Q: Do correspondent hotel lenders offer loans for hotel renovations?

A: Yes, many correspondent lenders offer a range of loan options, including bridge loans and SBA loans, specifically designed for hotel renovations.

Q: What are some common loan types available for hotel financing?

A: Common loan types include SBA loans (504 and 7(a)), bridge loans, conventional loans, and construction loans.

Contact Us

At [Your Company Name], we specialize in hotel financing and work as correspondent lenders to offer you the best loan options for your hotel project. Whether you’re looking to renovate, acquire, or build a hotel, our in-house underwriting expertise ensures fast approval and personalized loan structuring.Contact us today to explore your hotel financing options and speak with one of our experienced lenders.

Post Comment