Gold Price Trend Analysis and Market

Gold is a precious metal that has been valued for thousands of years for its beauty, rarity, and utility. Today, gold is used for various purposes, including jewelry, investment, and industrial applications. As a financial asset, gold is often considered a “safe haven” investment, meaning its price tends to rise during economic uncertainty. For this reason, tracking gold price trend is essential for investors, central banks, and industries that depend on the metal. This article explores the historical price trends of gold, the factors that influence its price, and the future outlook for the gold market.

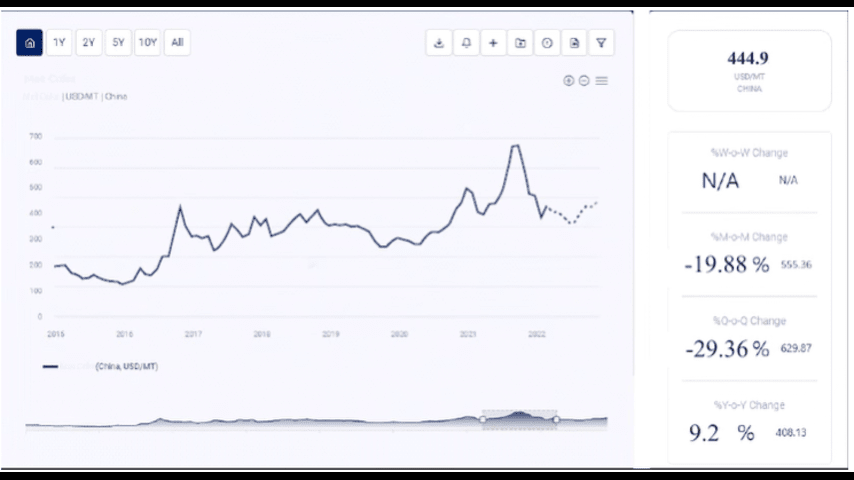

1. Historical Gold Price Trends

1.1 Early 2000s

In the early 2000s, gold prices were relatively low, averaging around $250 to $300 per ounce. However, as global economic conditions changed, the demand for gold began to rise:

- Growing Investment Demand: Economic instability and concerns about inflation led many investors to seek refuge in gold, causing prices to start climbing steadily.

- Geopolitical Events: Events such as the 9/11 attacks in 2001 increased demand for gold as a safe haven, prompting further price increases.

By 2005, gold prices had surpassed $400 per ounce as investors and central banks increased their gold holdings in response to global uncertainties.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/gold-price-trends/pricerequest

1.2 2006 to 2012

Between 2006 and 2012, gold prices experienced significant growth, reaching record highs:

- Global Financial Crisis: The 2008 financial crisis sparked a sharp rise in gold prices as investors sought safety from volatile stock markets and declining currency values. By 2011, gold prices peaked at around $1,900 per ounce.

- Quantitative Easing (QE): Central banks in the U.S. and Europe implemented QE programs to stimulate their economies, leading to fears of inflation and further boosting demand for gold.

- Rising Demand in Emerging Markets: Countries like China and India, where gold is culturally significant, saw rising demand for jewelry and investment. Both nations began increasing their gold reserves, contributing to higher global demand.

1.3 2013 to 2018

Following the peak in 2011, gold prices declined and then stabilized for several years. By 2013, gold prices had fallen to around $1,200 per ounce:

- Economic Recovery: As global economies recovered from the financial crisis, investor interest in gold waned. Stock markets surged, and investors redirected their funds to equities and other assets.

- Strong U.S. Dollar: A strong U.S. dollar made gold more expensive for foreign buyers, dampening demand and keeping prices relatively stable during this period.

- Interest Rates: Central banks began signaling higher interest rates, which reduced the appeal of gold, as higher rates offered better returns on interest-bearing assets compared to non-yielding gold.

Gold prices remained between $1,100 and $1,300 per ounce until 2018, reflecting a period of relative stability in global markets.

1.4 2019 to Present

Since 2019, gold prices have experienced renewed volatility due to various global events:

- COVID-19 Pandemic: The pandemic sparked a global economic crisis, leading to unprecedented stimulus measures by governments and central banks. The resulting uncertainty and inflation fears led gold prices to surge to record highs of over $2,000 per ounce in 2020.

- Geopolitical Tensions: Ongoing geopolitical conflicts, including U.S.-China trade tensions and Russia-Ukraine conflict, have created an uncertain global environment, driving up demand for gold.

- Inflation Concerns: In 2021 and 2022, concerns over rising inflation further supported gold prices, as investors sought to protect their portfolios from eroding purchasing power.

While gold prices have experienced fluctuations, they remain elevated, generally trading between $1,700 and $2,000 per ounce as of 2023.

2. Factors Influencing Gold Prices

2.1 Economic Uncertainty and Global Crises

Gold is often regarded as a “safe haven” investment, meaning it tends to rise in value during times of economic and political uncertainty:

- Financial Crises: During economic downturns or crises, investors flock to gold as a stable store of value, causing its price to rise.

- Geopolitical Events: Events such as wars, terrorist attacks, and international tensions can drive demand for gold, as it is viewed as a secure asset during turbulent times.

2.2 Inflation and Currency Values

Gold is often used as a hedge against inflation and currency devaluation:

- Inflation Hedge: As the value of paper currency declines due to inflation, the value of gold typically rises. Investors buy gold to preserve their purchasing power during inflationary periods.

- U.S. Dollar Strength: Since gold is priced in U.S. dollars, its price tends to rise when the dollar weakens, making gold more affordable for buyers in other currencies.

2.3 Interest Rates

Interest rates have an inverse relationship with gold prices:

- Low Interest Rates: When interest rates are low, the opportunity cost of holding non-yielding assets like gold decreases, making gold more attractive to investors.

- High Interest Rates: Conversely, when interest rates rise, gold becomes less appealing, as investors can earn returns from other interest-bearing assets.

2.4 Demand from Emerging Markets

Emerging markets, particularly China and India, play a significant role in global gold demand:

- Wealth Accumulation: As incomes rise in emerging markets, demand for gold as a status symbol and investment also increases, supporting gold prices.

2.5 Central Bank Reserves and Purchases

Central banks hold significant amounts of gold in their reserves, and their buying or selling activities can influence gold prices:

- Central Bank Purchases: When central banks increase their gold holdings, it signals confidence in gold as a stable store of value, driving up prices.

- Central Bank Sales: Conversely, when central banks sell gold, it can put downward pressure on prices, though large-scale selling has been rare in recent years.

3. Future Outlook for Gold Prices

Several trends are expected to influence gold prices in the coming years:

3.1 Continued Economic Uncertainty

With ongoing concerns over global economic instability, gold is likely to remain a popular investment choice. Geopolitical tensions, such as the U.S.-China rivalry and conflicts in the Middle East, could further drive demand for gold as a safe-haven asset.

3.2 Inflation and Monetary Policies

Central banks worldwide have implemented various stimulus measures to support their economies, which has led to rising inflation in many countries. If inflation continues, demand for gold as a hedge is likely to persist. Additionally, changes in monetary policy, such as interest rate adjustments by the Federal Reserve, will impact investor interest in gold.

3.3 Digital Gold and Alternative Investments

As technology advances, digital assets such as cryptocurrencies are gaining popularity as alternative investments. While this could reduce demand for gold among some investors, gold’s historical track record as a stable asset may continue to attract those seeking a hedge against volatility.

3.4 Demand from Emerging Markets

As incomes rise in countries like China and India, demand for gold in jewelry and investment is likely to remain strong. This cultural affinity for gold, combined with rising wealth, could continue to support long-term for the metal.

3.5 Sustainability and Responsible Sourcing

With increasing awareness of environmental and ethical issues, the gold industry faces pressure to adopt more sustainable and responsible sourcing practices. These initiatives may increase production costs, potentially leading to higher gold prices over time.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Post Comment