Global Laboratory Filtration Market Outlook and Forecast (2025–2033)

Market Overview

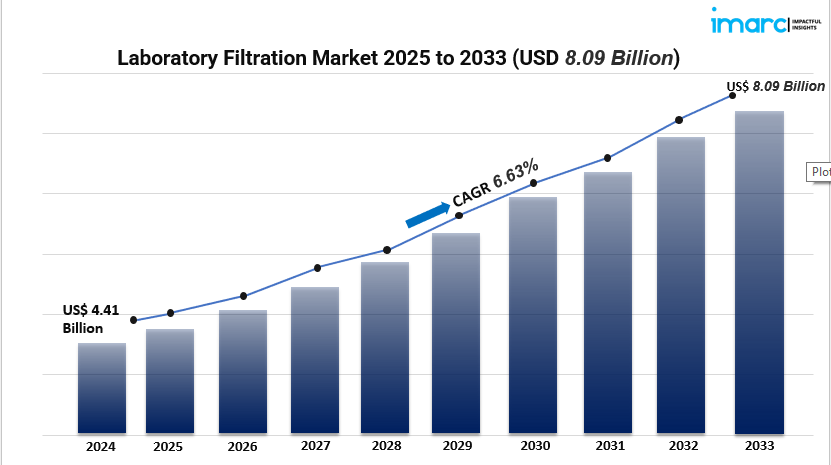

The global laboratory filtration market is experiencing significant growth, driven by increasing investments in pharmaceutical and biotechnology research, stringent regulatory standards, and advancements in filtration technologies. In 2024, the market was valued at USD 4.41 billion and is projected to reach USD 8.09 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.63% during the forecast period. North America currently leads the market, accounting for over 47.09% share in 2024, owing to robust life sciences research and the adoption of innovative filtration solutions.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Laboratory Filtration Market Key Takeaways

- Market Size & Growth: Valued at USD 4.41 billion in 2024, the market is expected to reach USD 8.09 billion by 2033, growing at a CAGR of 6.63%.

- Regional Dominance: North America holds the largest market share, driven by advanced biopharmaceutical production and stringent regulatory frameworks.

- Leading Product Segment: Filtration media is the largest component, accounting for 53.5% of the market share in 2024.

- Top Technique: Microfiltration leads with a 36.5% market share, essential for removing microorganisms and particulates in various applications.

- Primary End Users: Pharmaceutical and biopharmaceutical companies dominate due to their extensive use of filtration technologies in drug development and manufacturing.

- Technological Advancements: The integration of automated systems and robotics in laboratories enhances efficiency and compliance with regulatory standards.

- Adoption of Single-Use Systems: Increasing preference for single-use filtration systems due to their convenience and reduced contamination risks.

Market Growth Factors

1. Developments in Technology Increasing the Effectiveness of Filtration

The laboratory filtration industry is witnessing some significant technical advancements aimed at boosting both efficiency and accuracy. With the integration of automated systems and robotics, labs are reducing human errors and enhancing operational productivity. A great example of this is ABB Robotics’ partnership with XtalPi, which led to the creation of fully automated lab workstations in China back in December 2023. These innovations have streamlined research and development processes in fields like biopharmaceuticals and chemical engineering. Not only do these advancements help meet stringent regulatory standards, but they also contribute to market growth by cutting down on operational costs and manual labor.

2. Demand is being driven by strict regulatory standards

Regulatory agencies are imposing strict guidelines for the production of pharmaceuticals and biologics, which means that advanced filtration systems are essential to ensure product cleanliness and safety. Pharmaceutical and biotech companies are investing heavily in research and development, making high-quality filtration systems crucial for maintaining the integrity of their experiments and processes. The rising production of biologics, such as vaccines and monoclonal antibodies, further intensifies the demand for sophisticated filtration systems that can maintain sterility and prevent contamination.

3. Growing Need for Filtration Solutions with High Purity

The growing prevalence of chronic diseases and an aging population are increasing the need for accurate diagnostic testing and effective treatments, which in turn is boosting the market for high-purity filtering products. Achieving high accuracy and reliability in sample preparation is essential for obtaining precise diagnostic results, and this heavily relies on laboratory filtering systems. Additionally, the market is experiencing growth in laboratories and manufacturing plants due to the convenience, reduced contamination risks, and lower cleaning costs associated with single-use filtration systems.

Request for a sample copy of this report: https://www.imarcgroup.com/laboratory-filtration-market/requestsample

Market Segmentation

By Product Type

- Filtration Accessories:

- Filter Funnels: Used to channel liquids or fine-grained substances into containers with a small opening, ensuring minimal spillage.

- Filter Holders: Devices that secure filters in place during the filtration process, maintaining stability and efficiency.

- Filter Flasks: Specialized flasks designed to withstand vacuum pressure during filtration, commonly used in laboratory settings.

- Filter Dispensers: Tools that facilitate the easy and sterile dispensing of filters, enhancing laboratory workflow.

- Cartridges: Replaceable filter elements used to remove impurities from liquids or gases in various applications.

- Filter Housings: Structures that encase filter cartridges, providing a sealed environment for filtration processes.

- Seals: Components that ensure airtight connections within filtration systems, preventing leaks and contamination.

- Vacuum Pumps: Devices that create a vacuum to facilitate the filtration process, especially in vacuum filtration setups.

- Others: Includes various other accessories essential for efficient laboratory filtration operations.

- Filtration Media:

- Glass Microfiber Filter Papers: Ideal for capturing fine particles and aerosols, commonly used in air pollution monitoring.

- Cellulose Filter Papers: General-purpose filters suitable for a wide range of laboratory applications involving liquid filtration.

- Membrane Filters: Thin, porous films used to separate particles from liquids or gases, essential in microbiological analyses.

- Quartz Filter Papers: High-temperature resistant filters used in gravimetric analysis and air sampling of acidic gases.

- Syringeless Filters: Integrated devices that simplify sample preparation by combining filtration and sample storage.

- Syringe Filters: Single-use filters attached to syringes to remove particles from liquids before analysis.

- Filtration Microplates: Multi-well plates with filter bottoms, used for high-throughput filtration applications.

- Capsule Filters: Self-contained, disposable filters used for small-volume filtration of liquids and gases.

- Others: Encompasses additional filtration media catering to specific laboratory needs.

- Filtration Assemblies: Complete systems comprising various components designed to perform specific filtration tasks in laboratories.

By Technique

- Microfiltration: Utilizes membranes with pore sizes typically between 0.1 to 10 micrometers to remove bacteria and suspended solids from liquids.

- Ultrafiltration: Employs membranes with smaller pore sizes to separate macromolecules and colloidal particles from solvents.

- Reverse Osmosis: A process that removes ions, molecules, and larger particles from solutions by applying pressure through a semipermeable membrane.

- Vacuum Filtration: Involves the use of vacuum pressure to draw liquid through a filter, speeding up the filtration process.

- Others: Includes additional filtration techniques employed in specialized laboratory applications.

By End User

- Pharmaceutical and Biopharmaceutical Companies: Utilize advanced filtration systems to ensure product purity, comply with regulatory standards, and maintain contamination-free environments during drug development and manufacturing.

- Academic and Research Institutes: Rely on filtration technologies for various research applications, including sample preparation and analysis.

- Hospitals and Diagnostic Laboratories: Employ filtration systems to prepare samples for diagnostic testing, ensuring accuracy and reliability.

- Others: Encompasses additional entities utilizing laboratory filtration systems for specialized purposes.

By Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

North America is set to hold over 47.09% of the market share in 2024, making it a dominant player in the laboratory filtration industry. This leadership is attributed to advanced biopharmaceutical production capabilities, stringent regulatory frameworks, and a strong embrace of innovative filtration technologies. The United States, in particular, plays a vital role, fueled by significant investments in life sciences research and a robust pharmaceutical sector.

Recent Developments & News

- October 2024: Asahi Kasei Medical launched the Planova™ FG1, a next-generation virus removal filter that enhances productivity by offering seven times the flux of previous models, catering to the growing demand for biotherapeutics.

- June 2024: Cytiva introduced Supor Prime sterilizing grade filters, designed to improve yields and reduce filtration losses in high-concentration biologic drug applications.

- June 2024: Asahi Kasei developed a hollow-fiber membrane method for producing sterile water for injection, presenting an alternative to traditional distillation processes.

- March 2024: Asahi Kasei Medical Co., Ltd. launched Planova BioEX, next-generation hollow-fiber membrane viral filters aimed at enhancing safety in biopharmaceutical processing.

- February 2024: Freudenberg Performance Materials unveiled a new line of 100% synthetic wetlaid non-woven products, offering innovative solutions for filtration and various industrial processes.

Key Players

- 3M Company

- Agilent Technologies, Inc.

- Cantel Medical Corp.

- Danaher Corporation

- GE Healthcare Inc.

- GEA Group

- MACHEREY-NAGEL GmbH & Co. KG

- MANN + HUMMEL Group

- Sartorius AG

- Sigma-Aldrich Corporation

- Sterlitech Corporation

- Thermo Fisher Scientific

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2569&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145