Effective Bookkeeping Strategies for Medical Practices

In the complex world of healthcare, maintaining accurate financial records is crucial for the success and sustainability of medical practices. Implementing effective bookkeeping strategies ensures that medical professionals can focus on patient care while maintaining financial health.

The Importance of Specialized Bookkeeping in Healthcare

Medical practices encounter unique financial challenges, including insurance reimbursements, patient billing, and regulatory compliance. Engaging in bookkeeping allows practices to manage these complexities efficiently. Accurate financial records facilitate informed decision-making, ensure timely payments, and help in maintaining compliance with healthcare regulations. Medical bookkeeping is an essential tool for managing these financial aspects effectively.

Key Components of Bookkeeping

Accurate Expense Tracking

Recording all expenses meticulously is vital. This includes operational costs, medical supplies, payroll, and utilities. Detailed expense tracking aids in budgeting and identifying areas where cost reductions are possible.

Revenue Management

Efficient management of revenue streams, such as patient payments and insurance reimbursements, ensures steady cash flow. Implementing a structured system for invoicing and collections minimizes the risk of revenue loss. Medical bookkeeping services can provide essential support in handling these revenue streams effectively.

Regulatory Compliance

Adhering to healthcare regulations, including accurate coding and documentation, is essential. Non-compliance can lead to financial penalties and legal issues. Regular audits and updates to bookkeeping practices help maintain compliance.

Benefits of Professional Bookkeeping Services

Partnering with providers of bookkeeping services offers several advantages:

- Expertise in Healthcare Financial Management

Professionals specializing in bookkeeping possess in-depth knowledge of the financial intricacies specific to healthcare. They can navigate complex billing systems, insurance claims, and regulatory requirements effectively. - Time Efficiency

Outsourcing bookkeeping tasks allows medical practitioners to dedicate more time to patient care, enhancing overall productivity and service quality. - Financial Accuracy

Professional bookkeepers ensure that all financial records are accurate and up-to-date, reducing the likelihood of errors that could lead to financial discrepancies or compliance issues. Bookkeeping for medical practices is a crucial step toward financial stability.

Implementing Best Practices in Bookkeeping

Utilize Specialized Accounting Software

Investing in accounting software tailored for medical practices can streamline financial management. These platforms often include features for billing, coding, and financial reporting specific to healthcare.

Regular Financial Reviews

Conducting monthly financial reviews helps in monitoring the practice’s financial health. This includes reviewing income statements, balance sheets, and cash flow statements to identify trends and areas for improvement.

Staff Training and Development

Ensuring that administrative staff are trained in basic bookkeeping principles and the use of financial software enhances the accuracy of financial records and overall efficiency.

Challenges in Bookkeeping

Medical practices may face challenges such as:

- Complex Billing Processes

Navigating the intricacies of insurance billing and coding requires specialized knowledge and attention to detail. - Regulatory Changes

Staying updated with evolving healthcare regulations and ensuring compliance can be demanding. - Data Security

Protecting sensitive patient financial information is paramount, necessitating robust data security measures.

Enhancing Financial Planning and Forecasting in Medical Practices

One of the most critical aspects of bookkeeping in medical practices is the ability to effectively plan and forecast financial performance. Financial forecasting helps medical professionals anticipate potential financial challenges, allocate resources efficiently, and set realistic revenue goals. By leveraging detailed financial reports and historical data, healthcare providers can make strategic decisions to ensure long-term financial stability. Budgeting plays a key role in financial planning, as it helps control expenditures and optimize cash flow management. Establishing a well-structured budget allows medical practices to identify unnecessary expenses and reinvest in essential areas such as patient care, technology upgrades, and staff development. Moreover, financial planning supports the sustainability of medical practices by preparing them for economic fluctuations, changes in healthcare regulations, and unexpected operational costs. By implementing proactive financial forecasting, healthcare providers can reduce financial risks, improve decision-making, and enhance overall operational efficiency. Utilizing bookkeeping tools and professional expertise enables medical practices to achieve financial resilience while focusing on delivering high-quality healthcare services.

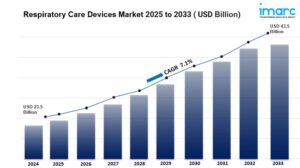

Future Trends in Medical Bookkeeping

With advancements in financial technology, the field of medical bookkeeping is evolving rapidly. The integration of artificial intelligence (AI) and automation into bookkeeping processes is reducing human errors and increasing efficiency. AI-powered software can analyze large volumes of financial data, detect inconsistencies, and provide real-time insights into a medical practice’s financial health. Additionally, cloud-based accounting systems are gaining popularity, allowing medical professionals to access financial data securely from any location. These innovations enable real-time collaboration between medical staff and bookkeeping professionals, ensuring seamless financial management. Moreover, regulatory compliance software is being implemented to automatically update practices on changes in tax codes and healthcare regulations. As technology continues to advance, adopting these tools will be critical for ensuring efficient and compliant bookkeeping in medical practices.

Conclusion

Effective bookkeeping is a cornerstone of successful medical practice management. By implementing structured financial management strategies and possibly engaging professional bookkeeping services, healthcare providers can ensure financial stability, compliance, and the ability to focus on delivering exceptional patient care.

Post Comment