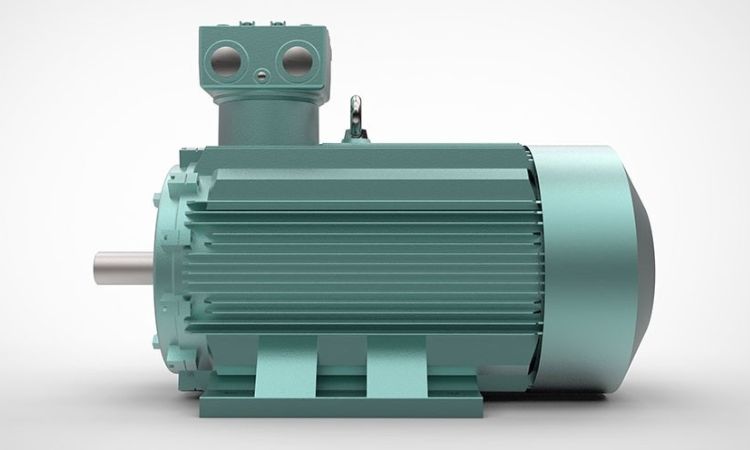

Saudi Arabia Low Voltage Electric Motor Market Analysis & Forecast | 2032

The Saudi Arabia Low Voltage Electric Motor Market Size is witnessing significant growth, driven by advancements in technology, increased industrialisation, and government initiatives promoting energy efficiency. With a market size of approximately USD 638.62 million in 2023, the sector is expected to grow at an impressive CAGR of 8.90%, reaching an estimated USD 1,376.42 million by 2032. This article delves into the market’s key aspects, including benefits, developments, drivers, restraints, segmentation, trends, and opportunities, while highlighting the major players and challenges in this evolving landscape.

Key Benefits of Low Voltage Electric Motors

- Energy Efficiency

Low voltage electric motors are designed to consume less power, aligning with Saudi Arabia’s focus on energy conservation and sustainability. - Cost Savings

These motors offer lower operational costs over their lifecycle, making them ideal for industrial applications in sectors like oil & gas, manufacturing, and water treatment. - Versatility

Their adaptability across various applications, from HVAC systems to automation, ensures wide usability in diverse industries. - Enhanced Durability

Built for reliability, these motors reduce downtime and maintenance costs, critical for industrial environments. - Regulatory Compliance

They meet energy efficiency standards, supporting industries in adhering to Saudi Vision 2030’s sustainability goals.

Key Industry Developments

- Expansion in Industrial Applications

Increased use of low voltage electric motors in petrochemicals, mining, and construction has boosted demand. - Government Initiatives

Saudi Vision 2030’s focus on industrial diversification and energy efficiency has incentivised local production and adoption of advanced motors. - Technological Advancements

Innovations like IoT-enabled smart motors and variable speed drives (VSDs) have enhanced motor performance and energy management capabilities. - Investments in Infrastructure

Major projects such as NEOM and The Red Sea Project have accelerated the demand for efficient and reliable motor solutions.

Driving Factors

- Industrial Growth

The expansion of manufacturing, construction, and petrochemical sectors is driving the demand for low voltage electric motors. - Energy Efficiency Goals

Growing awareness and government mandates for energy conservation are encouraging the adoption of efficient motors. - Rising Demand for Automation

The need for precision and efficiency in industrial processes has propelled the use of automated systems powered by low voltage motors. - Infrastructure Development

Large-scale projects under Saudi Vision 2030 are increasing the deployment of advanced electric motors. - Export Opportunities

Saudi Arabia’s strategic position and investments in local manufacturing make it a hub for regional exports.

Restraining Factors

- High Initial Costs

Advanced low voltage motors require significant upfront investment, deterring small and medium enterprises (SMEs). - Lack of Skilled Workforce

Limited expertise in operating and maintaining advanced motor systems can hinder adoption. - Economic Fluctuations

Dependence on oil revenues poses risks to infrastructure investments during periods of economic volatility.

Market Segmentation

- By Type

- Synchronous Motors

- Induction Motors

- Others

- By Application

- Industrial Machinery

- HVAC Systems

- Oil & Gas

- Construction

- Others

- By End-User

- Manufacturing

- Energy & Utilities

- Infrastructure

- Automotive

- Others

Market Outlook

The Saudi Arabia low voltage electric motor market is poised for robust growth due to increasing industrialisation, energy efficiency mandates, and ongoing infrastructure projects. Technological advancements in motor design and control systems are expected to further enhance market opportunities, catering to a wide range of applications.

Market Overview

Low voltage electric motors form the backbone of industrial operations in Saudi Arabia. They cater to diverse sectors, ensuring efficient and reliable performance. With a strong focus on reducing carbon emissions and energy costs, the adoption of these motors is projected to surge in the coming years.

Trends

- Smart Motor Integration

Integration of IoT and AI for predictive maintenance and performance optimisation. - Customised Solutions

Growing demand for tailored motor solutions to meet specific industrial requirements. - Shift Towards Renewable Energy

Increased use of low voltage motors in solar and wind energy applications. - Focus on Sustainability

Development of eco-friendly motors to align with global sustainability goals.

Industry Segmentation

- Industrial Machinery

Key driver of market growth, with applications in automation and heavy equipment. - HVAC Systems

Increasing demand for energy-efficient climate control systems in residential and commercial buildings. - Oil & Gas

Essential for operations like drilling, pumping, and refining. - Construction

Infrastructure projects under Saudi Vision 2030 significantly contribute to market expansion.

Regional Analysis/Insights

The market is concentrated in industrial hubs like Riyadh, Jeddah, and Dammam, where most infrastructure projects and manufacturing activities are located. Coastal regions are also experiencing growth due to increased demand for desalination plants powered by low voltage electric motors.

Opportunities

- Technological Advancements

Development of energy-efficient and smart motor systems. - Growing Infrastructure Projects

High demand for motors in large-scale initiatives like NEOM and Qiddiya. - Export Potential

Expansion into neighbouring GCC countries with similar industrial needs.

Challenges

- Economic Dependency on Oil

Fluctuating oil prices can impact industrial investments. - Competition from Imports

Availability of cheaper imports may affect local manufacturers. - Skill Shortage

Need for skilled technicians to handle advanced motor systems.

Restraints

- High Initial Costs

Advanced motors require significant capital expenditure. - Market Fragmentation

Presence of numerous local and international players intensifies competition. - Economic Instability

Macroeconomic uncertainties can hinder growth.

Scope

The Saudi Arabia low voltage electric motor market offers vast potential, driven by government initiatives, technological advancements, and increasing industrialisation. By fostering local manufacturing capabilities and focusing on R&D, the market can achieve sustained growth.

Major Key Players

- ABB Ltd.

- Siemens AG

- WEG Industries

- TECO Electric & Machinery Co., Ltd.

- Nidec Corporation

- Toshiba International Corporation

- Regal Rexnord Corporation

- Wolong Electric Group

- Hyundai Electric & Energy Systems

- Leroy-Somer (Nidec)

News

- New Manufacturing Plants: Several companies have announced plans to establish local manufacturing facilities to reduce dependence on imports.

- Smart Motor Launches: Innovations in IoT-enabled motors have gained traction, catering to automation needs.

Top Impacting Factors

- Policy Support

Government initiatives for industrial diversification and energy efficiency. - Technological Innovations

Rapid advancements in motor technology. - Infrastructure Growth

Increasing construction and industrial activities.

Target Audience

- Industrial manufacturers

- Construction companies

- Energy and utility providers

- OEMs and system integrators

- Research and development firms

Post Comment