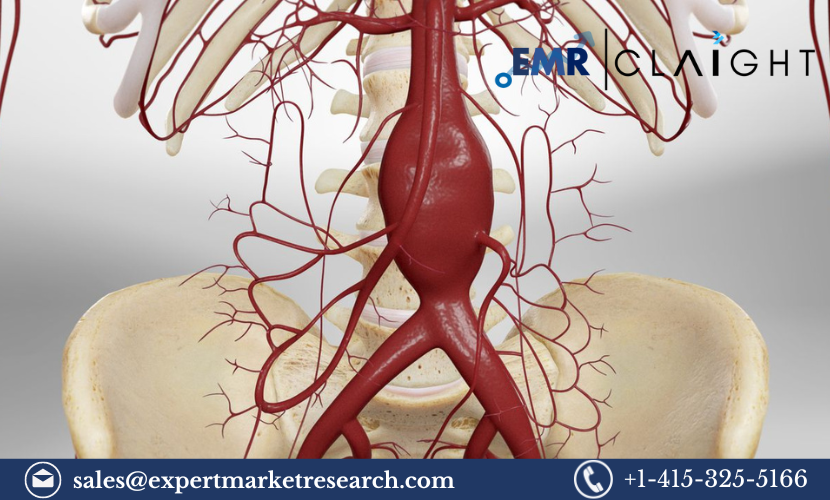

North America Aortic Stent Graft Market: Growth Drivers, Innovations, and Market 2032

The North America aortic stent graft market, valued at USD 3.1 billion in 2023, is on a trajectory to hit USD 5.2 billion by 2032, growing at a CAGR of 5.8%. This rise is fueled by an aging population, increasing cases of aortic aneurysms, and groundbreaking innovations in stent graft technology. This blog explores the drivers, emerging technologies, competitive landscape, and future growth opportunities in the aortic stent graft market.

1. Understanding the Growth Drivers of the Aortic Stent Graft Market

- Aging Population Impact: North America’s demographic shift toward an older population significantly influences the market. Individuals over 65 are at a higher risk of developing aortic aneurysms, a condition that requires stent grafts. This demographic’s growth directly correlates with the increasing demand for vascular solutions.

- Rise in Cardiovascular Conditions: Lifestyle factors such as high cholesterol, sedentary habits, and smoking contribute to vascular issues, including aortic aneurysms, thereby boosting the demand for aortic stent grafts. The Centers for Disease Control and Prevention (CDC) estimates that cardiovascular diseases are among the leading causes of death in North America, which further drives market growth.

- Advancements in Minimally Invasive Techniques: Traditionally, open surgery was the standard for treating aortic aneurysms, but minimally invasive procedures, like endovascular aneurysm repair (EVAR), are becoming the new standard. These procedures use advanced stent grafts, resulting in fewer complications, shorter hospital stays, and quicker recovery times, making them a preferred choice for both patients and healthcare providers.

2. Trending Innovations Reshaping the Market

- Next-Generation Stent Graft Materials and Designs: Leading companies are pioneering the use of smart materials in stent grafts. Innovations include polymer-based stent grafts that provide enhanced flexibility, allowing for better conformity to patient anatomy, and metal-based grafts that ensure strength and durability. Newer grafts are also designed to be more adaptive to the dynamic environment within blood vessels, reducing long-term complications.

- AI Integration in Vascular Procedures: Artificial Intelligence (AI) is starting to play a crucial role in vascular treatments. AI-powered imaging and 3D modeling enable more precise stent graft placements, tailored to individual anatomies. This reduces the risk of misplacements or complications, which can be life-threatening in aortic surgeries. AI-driven robotics are also emerging, assisting surgeons in complex procedures with greater accuracy and control.

- Sustainable and Biodegradable Medical Materials: As environmental sustainability becomes more important, companies are focusing on creating biodegradable stent grafts or exploring production processes that reduce environmental impact. Though still in early stages, biodegradable materials could offer a solution to avoid long-term complications that sometimes arise with permanent grafts.

3. Competitive Landscape: Who are the Key Players and What Strategies are They Adopting?

The North American market is competitive, with key players investing heavily in R&D, patents, and partnerships. Here are a few major companies and their strategies:

- Medtronic Plc.: Medtronic is a leader in producing aortic stent grafts designed to improve surgical outcomes. The company invests significantly in R&D and collaborates with healthcare providers to develop more advanced, patient-focused solutions. Medtronic’s stent grafts are known for their durability and ability to conform to complex anatomies, a feature that appeals to healthcare providers seeking reliable solutions for high-risk patients.

- W.L. Gore & Associates: Known for its expertise in materials science, Gore has developed some of the most flexible and durable grafts in the market. Their ePTFE (expanded polytetrafluoroethylene) grafts are particularly renowned for compatibility and flexibility, making them suitable for minimally invasive procedures.

- Cook Medical Inc.: Cook Medical has a strong focus on minimally invasive vascular solutions, pioneering new approaches to aneurysm repair. Cook’s stent grafts are designed to reduce recovery times and improve overall patient comfort, which aligns with the market’s shift toward non-invasive procedures.

- Other Notable Players: MicroPort Scientific, Endologix, Terumo Corporation, and CryoLife Inc. are also prominent in this space, each bringing unique strengths in material innovation, design, and procedural flexibility.

4. Market Forecast and Future Growth Opportunities (2024-2032)

The North American aortic stent graft market is forecasted to reach USD 5.2 billion by 2032, driven by continuous advancements and growing demand. Here’s what to expect in the coming years:

- Increased Funding in R&D and Innovation: Leading companies are investing millions into R&D to innovate stent graft designs, focusing on making them adaptable, durable, and bio-compatible. Innovations are also happening in manufacturing, where faster production cycles are becoming possible, allowing for more efficient scaling.

- Partnerships with Healthcare Providers and Research Institutions: As minimally invasive surgeries become more prevalent, partnerships are forming between healthcare providers and stent graft companies. These collaborations focus on tailoring products to meet clinical needs, developing new training programs for surgeons, and improving patient education.

- Shift Towards Customizable and Personalized Medicine: Personalized medicine is an emerging trend in the market, where grafts are customized based on individual patient anatomies. This development is especially important in complex cases where standard stent grafts may not fit properly, which can lead to complications.

“The future of stent grafts is not just in mass production but in personalization, where AI and customized designs work together to meet each patient’s unique needs.”

5. Technological Advancements in the Market

- Materials Science Advances: The field of materials science has contributed substantially to the development of next-gen stent grafts. Advances include polymers that are highly flexible yet durable, as well as metallic stents that maintain shape memory, crucial for adapting to dynamic vessel conditions.

- Improvements in Imaging and Robotics: Robotic-assisted procedures, guided by AI-powered imaging, are making stent graft placements more precise. Advanced imaging helps identify exact placement points, improving procedural success rates. Robotics, in turn, allows for minimal surgical intervention, a trend that’s appealing to both patients and healthcare providers.

- Regulatory Support and FDA Approvals: Regulatory bodies are increasingly supportive of new technologies that improve patient outcomes. FDA’s expedited approval processes for life-saving devices have facilitated faster market entry for newer stent grafts, a factor driving innovation and competition in the industry.

Post Comment