Accelerate Decision Making via Financial Spreading Automation

Are you seeking a faster, more reliable way to analyze financial data and make smarter decisions? In this blog, we explore how financial spreading automation transforms decision-making by streamlining financial statement extraction, standardization, and reconciliation. You will learn how this technology elevates efficiency, accuracy, and insight from commercial lending and equity research to financial modeling while aligning with the service capabilities outlined on the Collatio product page.

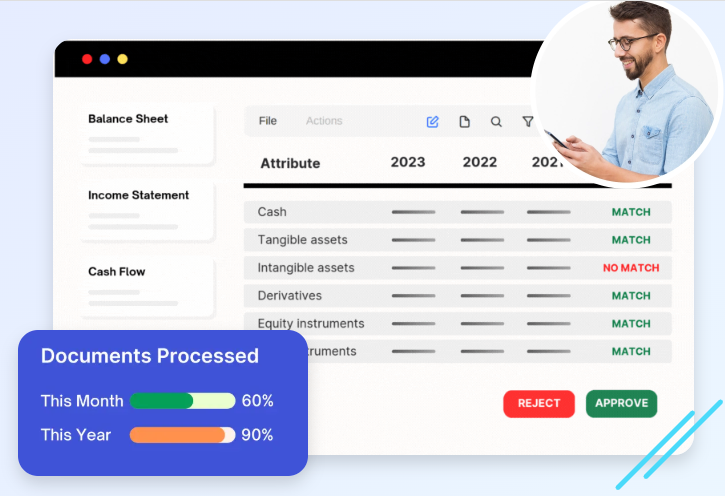

Understanding Financial Spreading Automation

Financial spreading automation refers to automating the process of extracting data from income statements, balance sheets, cash flows, and notes and then normalizing and reconciling that data into structured formats. It replaces manual spreadsheet tasks with advanced document AI and OCR technologies. As reported, leading platforms achieve 98% extraction accuracy and seamless reconciliation across complex financial statements, as this precision ensures that data is consistently classified, validated, and ready for analysis.

Speed of Data Extraction and Cleansing

A primary benefit of financial spreading automation is dramatically reducing how long analysts spend on data entry and cleanup. Instead of manually copying numbers across documents, the system populates templates automatically, using semantic tagging to distinguish data points like operating income from net income. The result is a significant reduction in turnaround time from days to minutes freeing up valuable time for high-level tasks such as risk assessment and modeling.

Built‑In Reconciliation for Reliable Insights

Another essential advantage of financial spreading automation is its ability to reconcile financial statements automatically. For example, the platform verifies that retained earnings align with net income and that cash flows match balance sheet movements and corresponding notes. This end-to-end consistency dramatically reduces error rates and ensures audit-grade accuracy, making each data point auditable and trustworthy.

Automated Ratio Analysis and Scoring

Once statements are standardized and reconciled, financial spreading automation calculates key financial ratios liquidity, solvency, profitability and applies real-time risk-scoring models. These instant metrics allow analysts and lenders to quickly assess creditworthiness and financial health, increasing speed and confidence in decision-making.

Applications Across Financial Disciplines

Let’s explore how financial spreading automation applies in real-world financial contexts:

Commercial Lending

Automation accelerates credit assessments by rapidly analyzing borrower liquidity and solvency while reconciling inconsistencies. Faster underwriting leads to quicker loan decisions and more scalable operations.

Equity Research and Investment Banking

Analysts benefit from clean, structured data across peer sets and global markets. Normalized financials enable better valuation modeling, faster trend spotting, and deeper due diligence.

Financial Modeling

Models thrive on accuracy. With automated inputs, modeling teams can compare historical performance, forecast trends, and produce reliable scenarios backed by auditable document lineage and integrated dashboards.

Efficiency Gains and Risk Reduction

By automating extraction and reconciliation, financial teams can achieve:

- Reduced turnaround time: Manual processes that took days now take minutes

- Operational consistency: Analysts use standardized data, reducing subjective formatting differences.

- Fewer errors: Automated cross-sheet validation minimizes human slip-ups and supports regulatory compliance

Centralized Document Management and Analytics Hub

Modern financial spreading automation includes a central hub for document management and onboarding. From a unified platform, analysts can access structured financials, document metadata, and trend analytics. Interactive dashboards provide visibility into data quality, spread progress, and financial scoring, accelerating decision cycles and supporting audit trails.

Ensuring Scalability and Global Reach

Organizations operating across borders benefit from financial spreading automation that supports multi-language documents and formats. Whether dealing with PDFs, scanned reports, or charts in different languages, the system maps data into standardized templates enabling global scalability and consistent processes.

Matching Company Features from Collatio

The capabilities described reflect the Collatio offering:

- AI-powered document scanning and OCR with model-based extraction accuracy

- Semantic classification of financial statements and notes

- Automated reconciliation across multi-sheet financials

- Financial ratio computation and built-in scoring models

- Centralized onboarding and document management hub

- Intuitive dashboards for analytics and process oversight

- 99%+ precision on scanned documents and multi-language support

There are no mismatches. This blog aligns perfectly with the functionalities described by the tool.

How to Implement Financial Spreading Automation

To adopt financial spreading automation, follow these steps:

- Gather current reporting formats PDFs, scanned, or multi-column layout documents.

- Upload to an automated platform and map data extraction templates.

- Validate initial mappings to confirm accuracy.

- Launch a reconciliation process across statements and notes.

- Set up dashboards for ratio tracking, trend analysis, and portfolio monitoring.

- Incorporate audit logs for regulatory compliance and documentation.

These steps walk your finance team from traditional spreadsheets to streamlined, automated decision-making.

Conclusion

As financial operations grow in complexity and volume, making timely and well-informed decisions is more critical than ever. Financial spreading automation provides a powerful solution by transforming traditional, manual processes into streamlined, intelligent workflows. From extracting and standardizing financial data to automatically reconciling statements and generating real-time insights, the benefits span speed, accuracy, and operational efficiency.

For institutions involved in lending, investment analysis, or financial modeling, this automation significantly reduces turnaround times, minimizes human error, and ensures accurate, audit-ready data support every decision. Moreover, centralized dashboards and automated ratio analysis help stakeholders respond faster to risks, opportunities, and compliance needs.

By adopting a robust financial spreading automation process, financial teams can shift their focus from data entry to strategic analysis empowering smarter, scalable, defensible decisions. In a market where timing and data integrity can define outcomes, automation is not just an enhancement it’s a necessity.